Danish credit institutions have significant exposures to real estate companies, which have increased further in recent years. During the financial crises exposures to real estate were one of the areas with the highest risk of impairments. At the same time distressed banks were to a large extent characterized by a prior high increase in lending and a high concentration of large exposures to the real estate sector. Higher interest rates and a weakening of economic growth have a negative impact on the real estate companies’ finances. This increases the risk that real estate companies will not be able to service their loans based on their current profits. In addition, declining prices in the commercial real estate market may increase the size of potential losses for the institutions. This entails a risk that problems in the real estate sector may affect financial stability.

The purpose of the buffer is to increase the credit institutions’ capitalisation, making them better able to withstand impairment charges and losses on their loans to real estate companies. This will contribute to ensuring financial stability in Denmark, among other things by ensuring that the credit institutions still have adequate lending capacity, despite any losses, to enable them to lend to creditworthy households and businesses. It is expected that the measure will correspond to a half per cent of the credit institutions’ total risk-weighted exposure amount.

To ensure a level playing field for Danish and foreign banks with exposures in Denmark, the Council recommends that the Minister requests that the authorities in other relevant countries acknowledge the systemic risk buffer rate of 7 per cent for exposures to real estate companies in Denmark. This will also contribute to the resilience of the institutions.

The Minister for Industry, Business and Financial Affairs is required, within a period of three months, to either comply with the recommendation or to present a statement explaining why the recommendation has not been complied with.

1. Grounds

The institutions have significant exposures to real estate companies, and they have increased further in recent years. Experience from, for example, the financial crisis shows that these exposures may result in substantial losses for credit institutions. This entails a risk that problems in the real estate sector may affect financial stability.

A number of significant factors point at build-up of risks in real estate companies

The Council assesses that there are a number of systemic risks related to the institutions’ real estate exposures that should be addressed with a sector-specific systemic risk buffer. In its assessment, the Council has attached particular importance to the following factors:

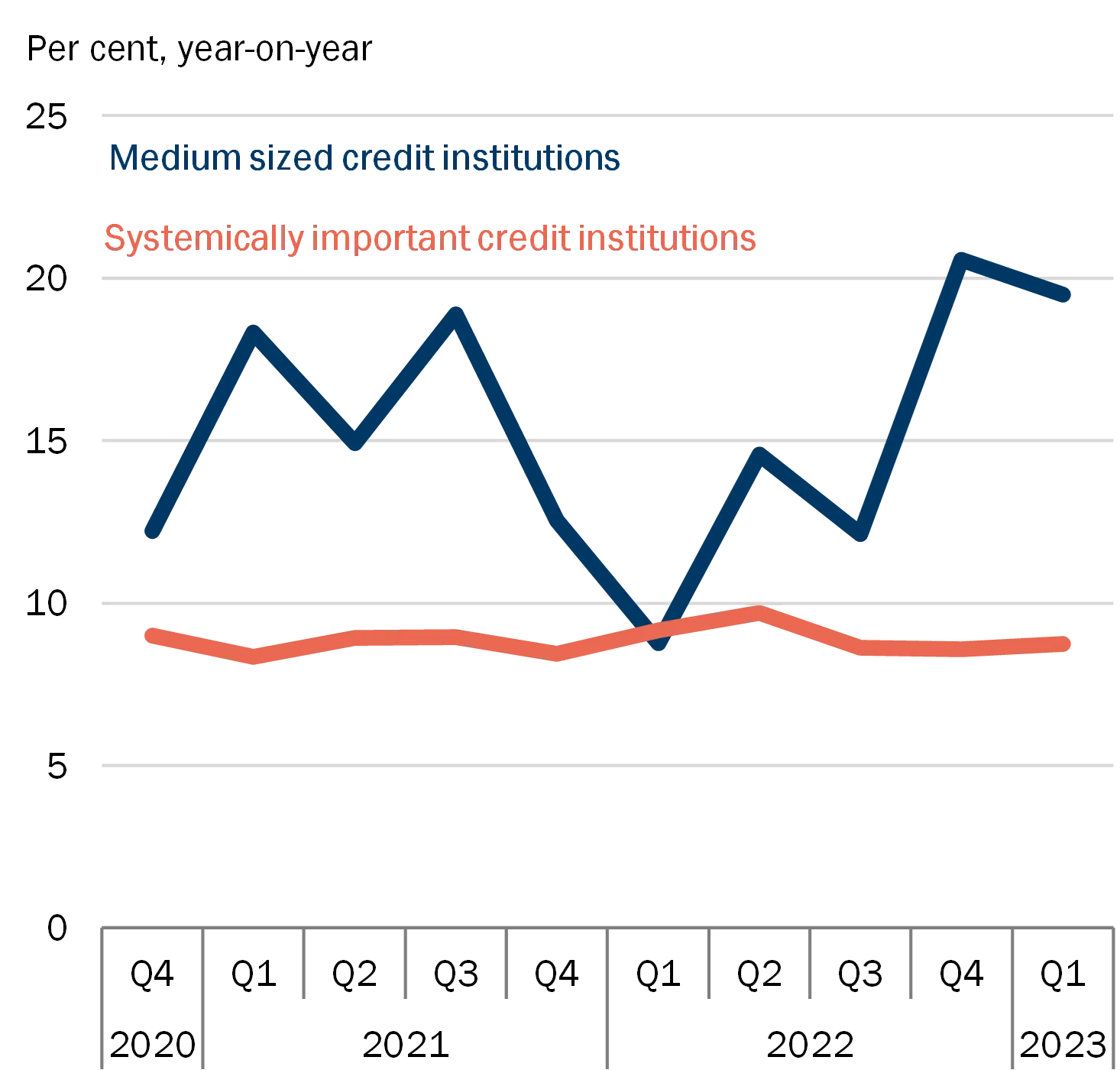

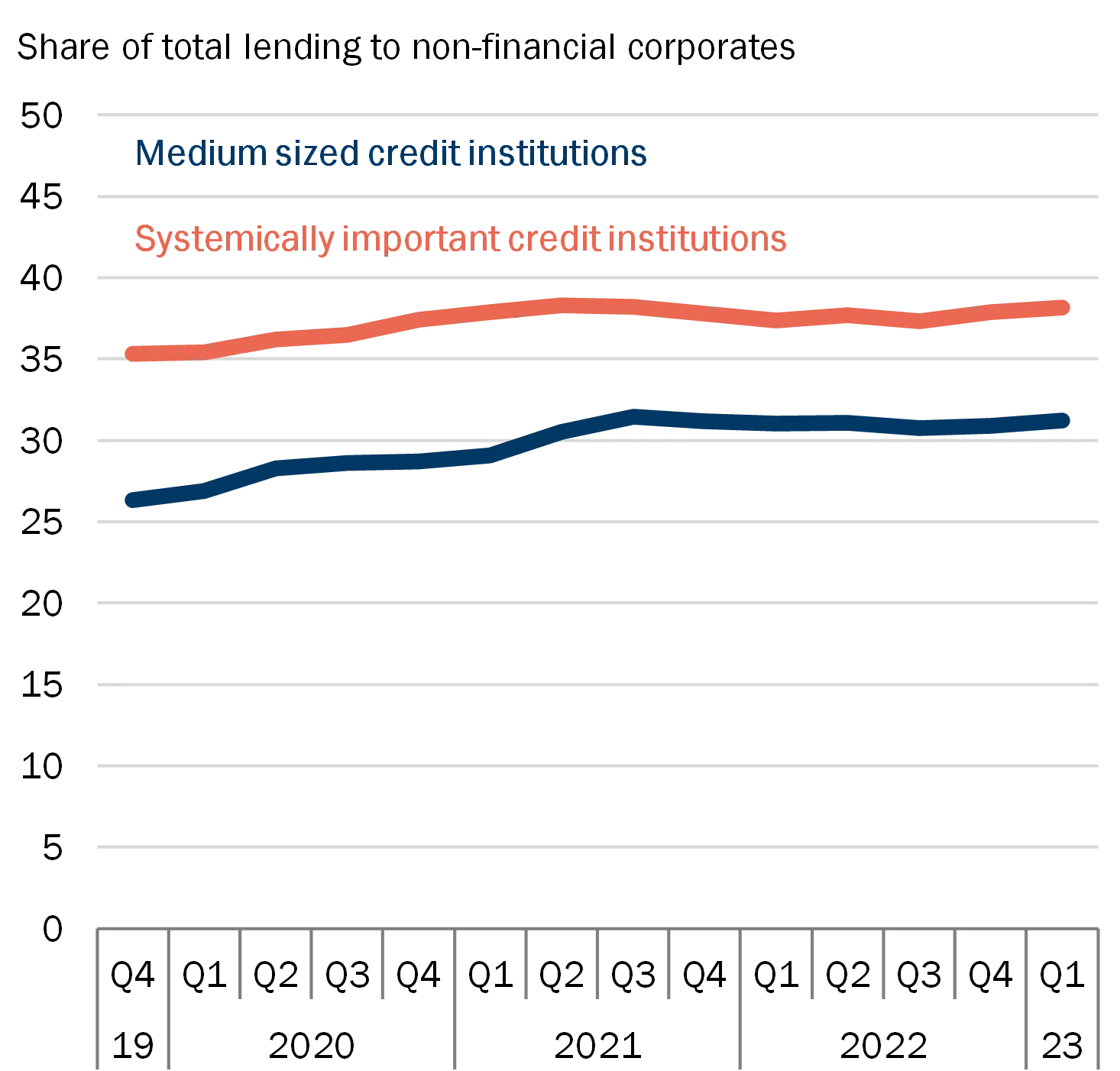

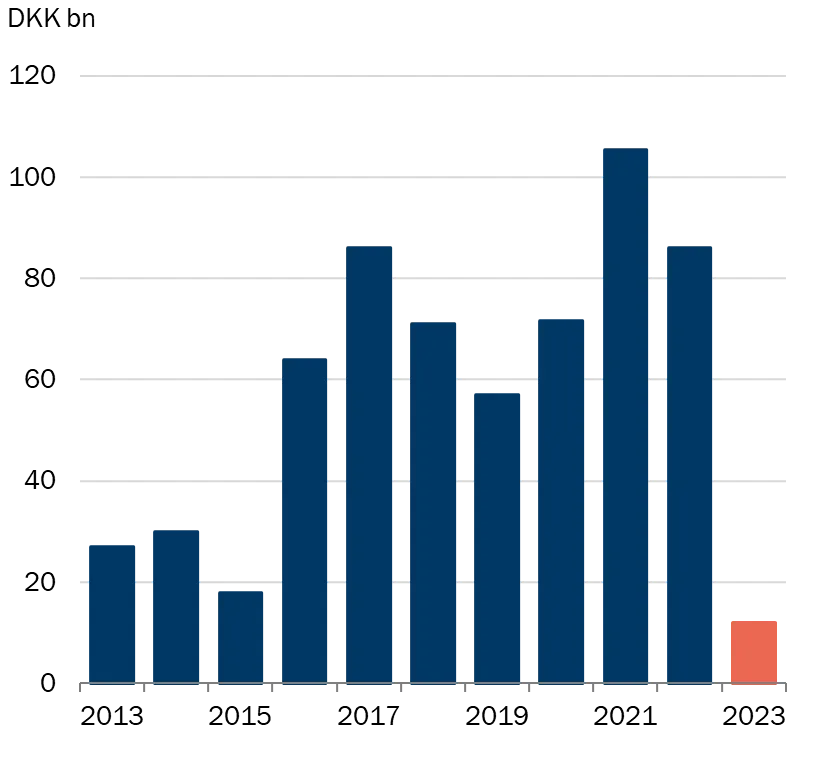

- Both large and medium-sized credit institutions have significant and growing exposures to real estate companies. Historically, periods with high lending growth have often been followed by rising impairment charges and losses. This reflects the tendency for credit quality to deteriorate in periods with high lending growth. As loans to real estate companies represent a significant share of the exposures, a negative shock may initially lead to significant losses for the institutions. During the crisis in the 1990s and the financial crises, many of the failing institutions had previously seen high lending rate and a high concentration of large commitments in the real estate sector.[1]

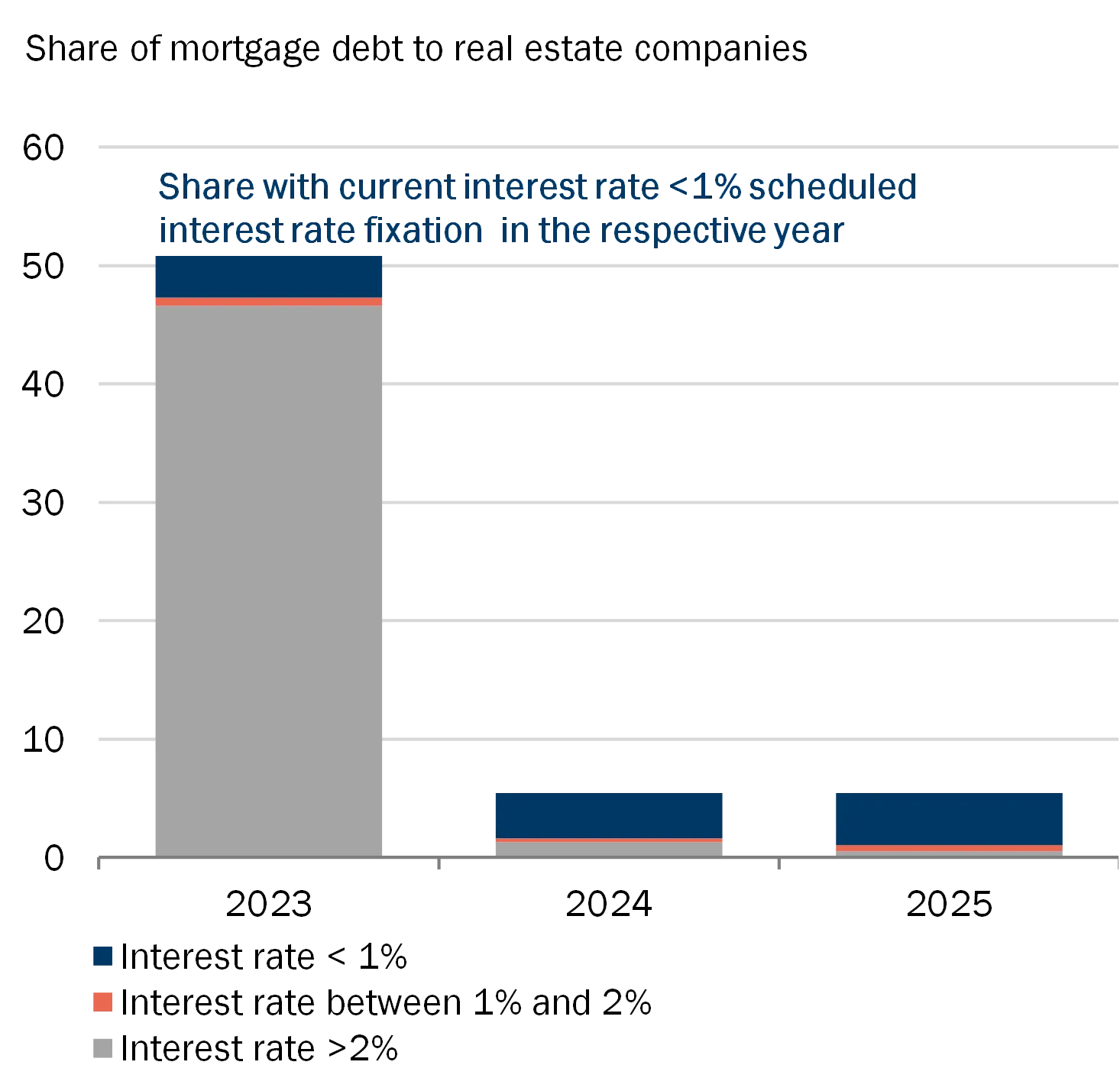

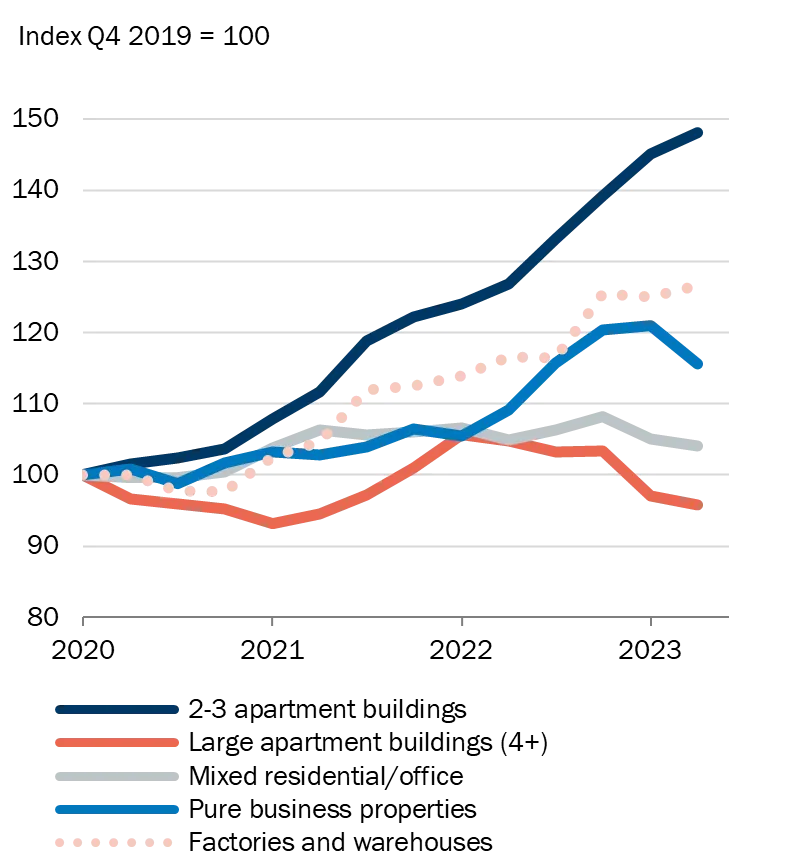

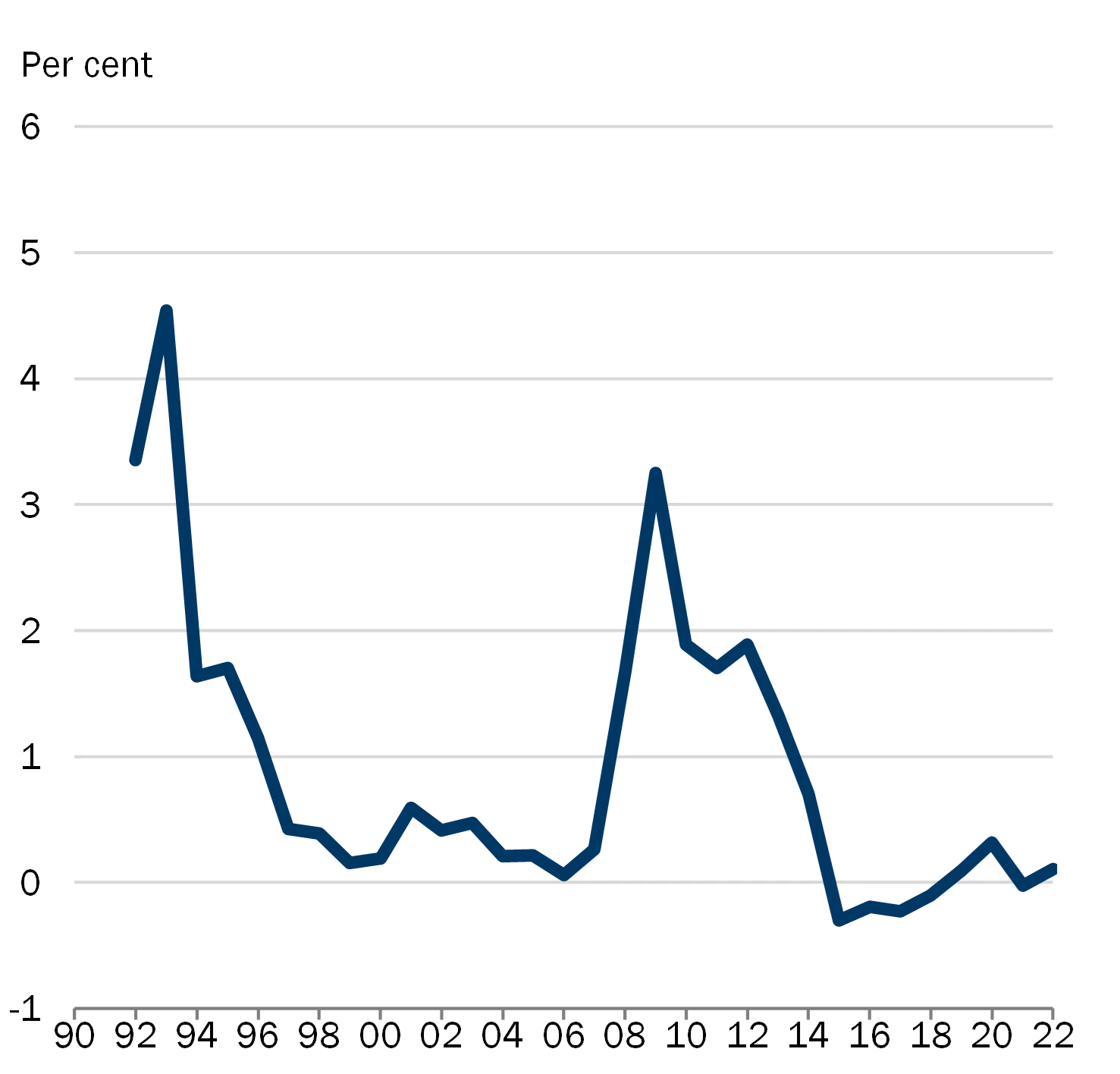

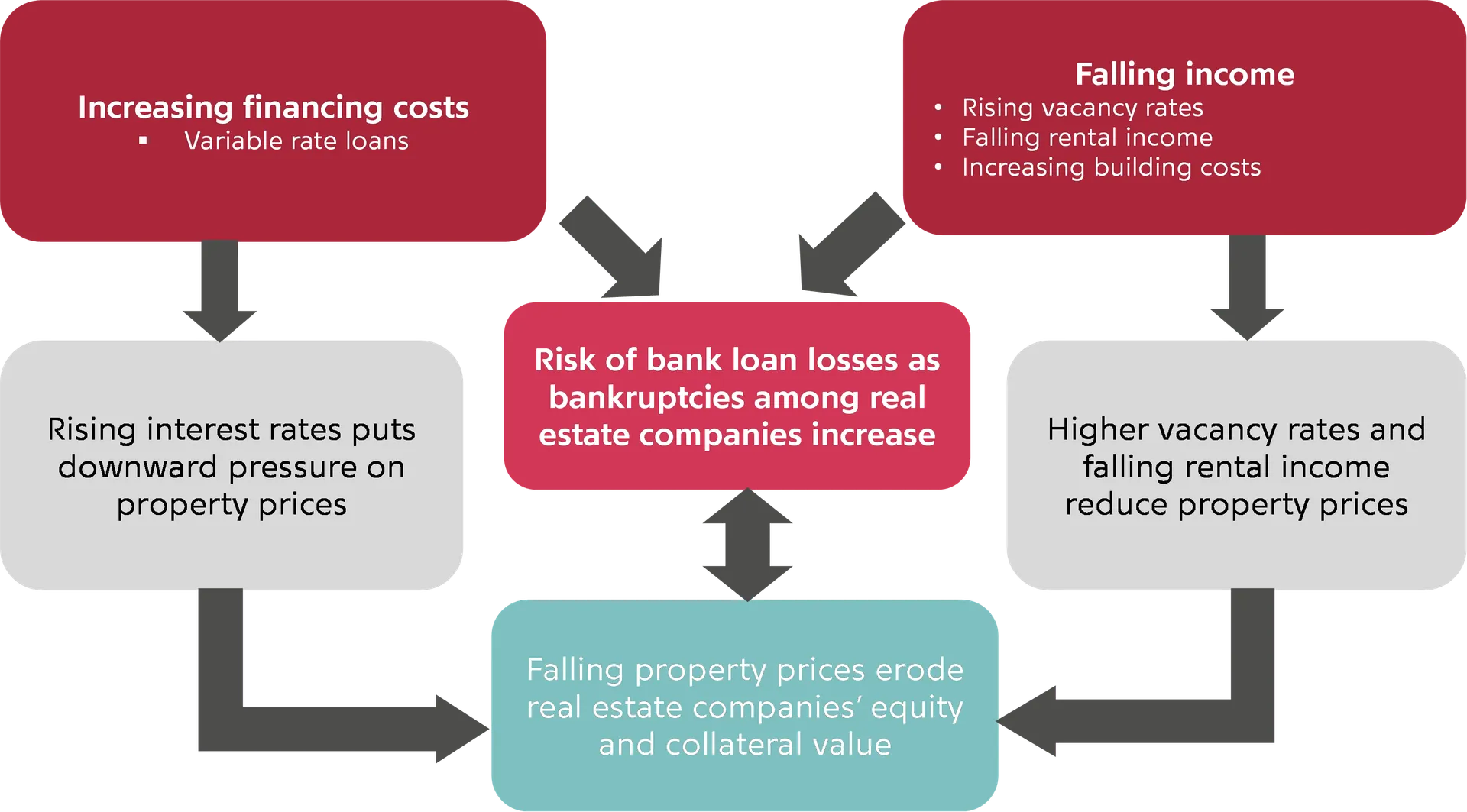

- Higher interest rates and a weakening of economic growth have a negative impact on real estate companies’ finances. Interest rates have risen sharply since the beginning of 2022, resulting in higher interest costs for the companies. Previous interest rate increases have not necessarily been fully reflected in real estate prices and the companies’ income. The real estate companies’ rental income may also come under pressure in the event of a weakening of economic activity, through e.g. higher vacancy rates. This increases the risk that real estate companies will not be able to service their loans based on their current profits. Finally, there is a risk of further increases in interest rates.

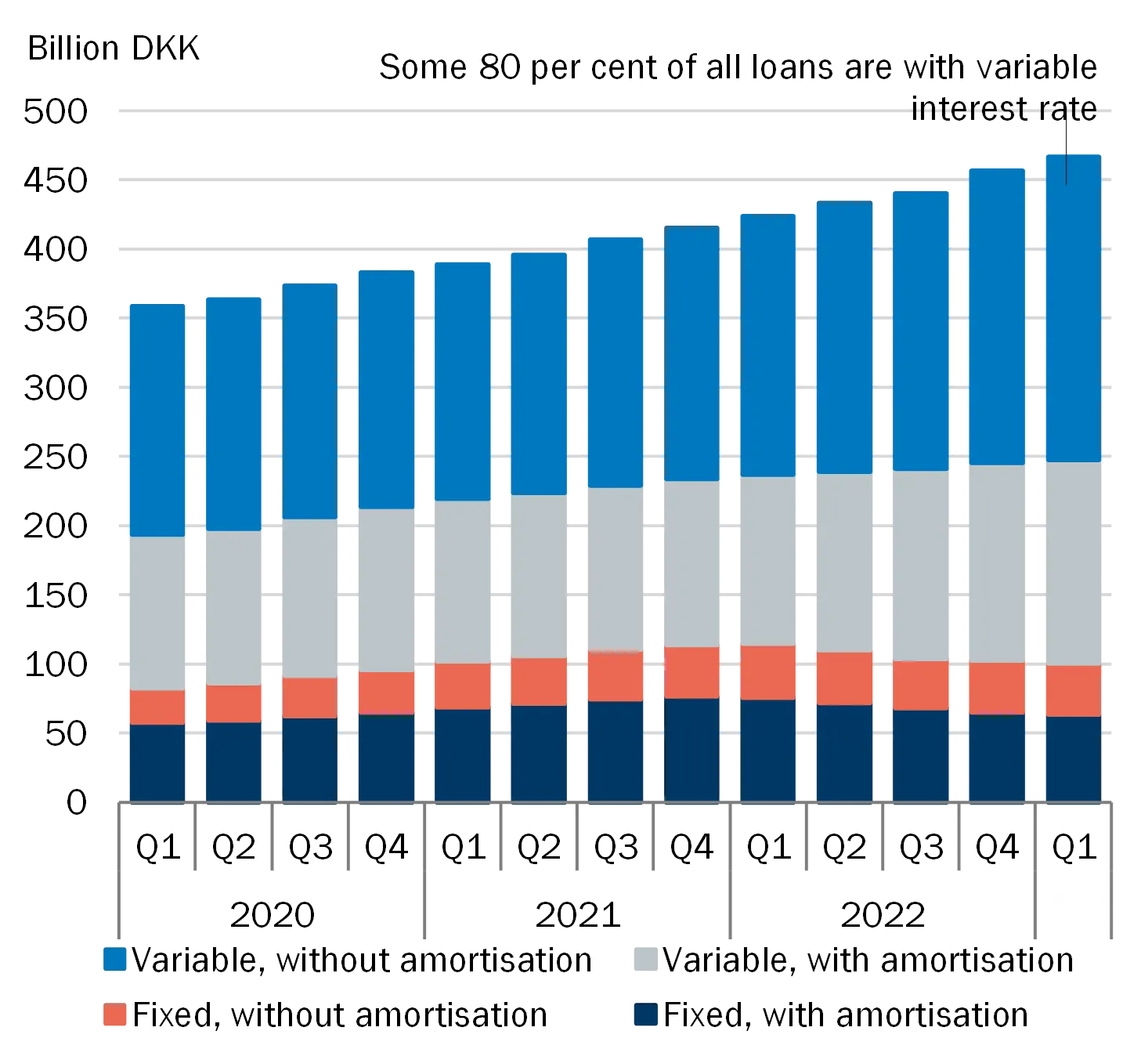

- Declining prices in the commercial real estate market may increase the size of potential loan losses for credit institutions. Interest rate levels and general levels of economic activity have a significant impact on the value of the properties used as collateral for the loans. A very limited number of transactions during 2023 indicate that buyers and sellers are far from each other, and that a sale would require a downward price adjustment. This entails a risk of price falls, which will increase credit institutions’ potential losses. In addition, a significant share of loans has high loan-to-value ratios and variable interest rates. Overall, this might lead to significant losses if real estate companies default on their loans.

- Problems in the real estate sector may quickly spread to the rest of the economy. The real estate sector constitutes an important part of the economy. Historically, the development in the commercial real estate sector has contributed to amplifying cyclical fluctuations, for example via its effect on construction activity. Problems in the real estate sector can therefore lead to losses on loans to other industries and among households.

- The sharply rising inflation and interest rate increases seen in recent years, combined with the risk of falling commercial real estate prices, are an extremely rare scenario. There is consequently a risk that problems in the real estate sector may result in losses which are significantly higher than would be expected based on historical data and for which the institutions have therefore not made capital provisions.

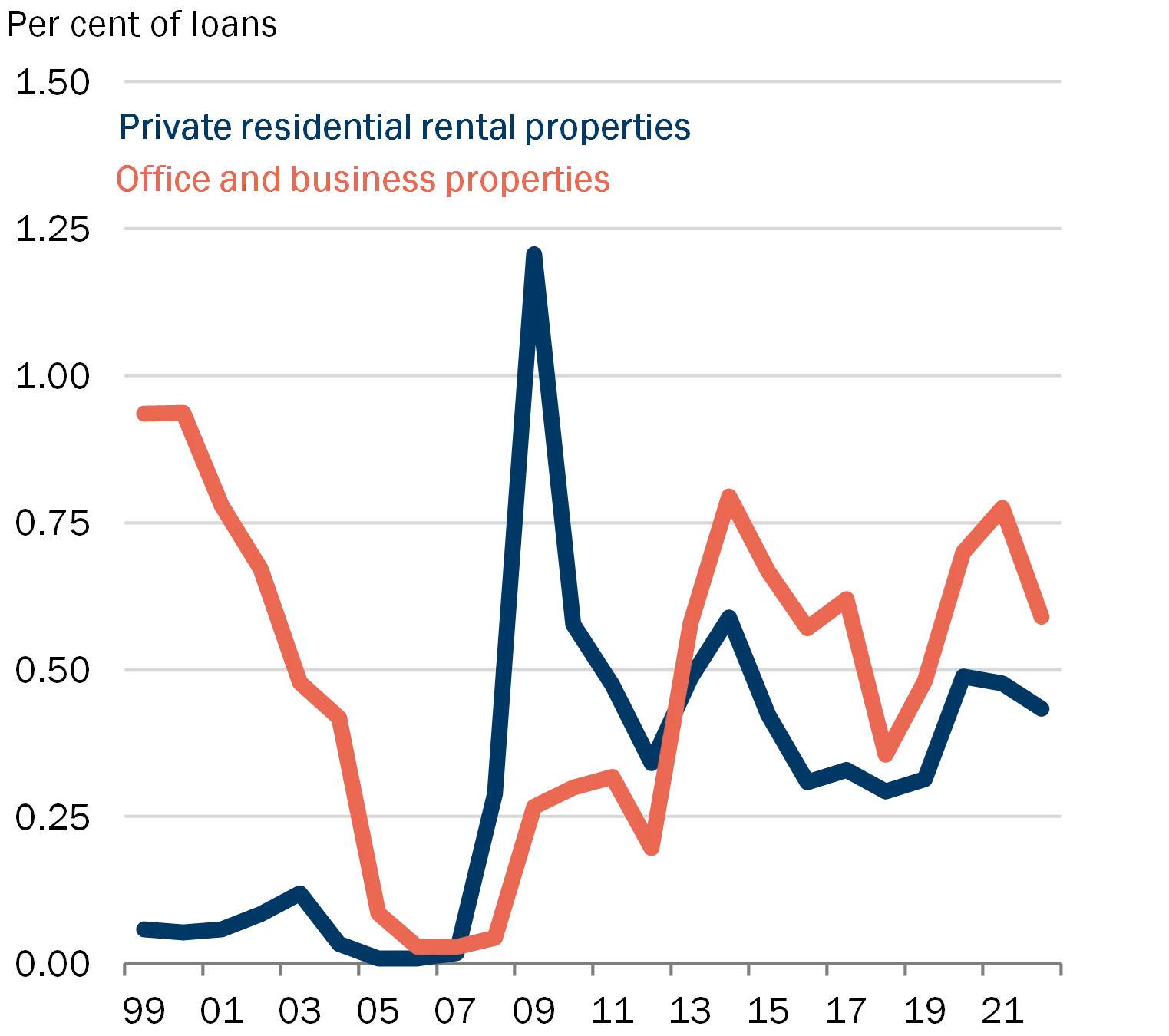

- Credit institutions’ impairment charges on commercial real estate exposures are currently low seen from a historical perspective. This reflects a period of extraordinarily low interest rates and thus extraordinarily low financing costs. A long period characterised by favourable conditions and low impairment charge ratios may lead to an underestimation of the actual risks related to the segment and result in insufficient provisions. Experience from previous crises shows that negative shocks to the real estate sector may lead to a sudden increase in impairment charges and losses.

These are consequently significant systemic risks that may affect Danish credit institutions via several channels, see chart 1.

|

Rising interest rates and an economic slowdown increase the risk of losses in institutions via several channels |

Chart 1 |

|

|

||

|

|

|

|

Overall, there are indications of an increasing level of systemic risks related to the commercial real estate market, while credit institutions’ capitalisation has remained largely unchanged. Measures are therefore needed to ensure that credit institutions’ capitalisation is increased.

Buffer must ensure sufficient capital to cover potential losses

Activating a sector-specific systemic risk buffer will secure more capital in the credit institutions, enabling them to bear any potential losses, without constraining credit to sound households and firms. This reduces the risk that credit institutions need to tighten their credit standards in order to comply with regulatory requirements. Such a tightening will entail costs for society and the economy, among other things because creditworthy households and firms are not able to obtain loans.

The Council assesses that the activation of a sector-specific systemic risk buffer of 7 per cent for exposures to real estate companies is necessary to address the systemic risk associated with the commercial real estate market. The rate of the systemic risk buffer reflects the increased risk that real estate companies might experience problems and default on their loans in a scenario with higher interest rates and falling income as well as potentially higher losses that a price fall in the market may entail. The size of the buffer rate is further based on the assumption that a significant share of real estate companies uses interest rate hedging for variable rate loans. In addition, existing provisions in the institutions’ impairment charges and capital targets have been taken into consideration.

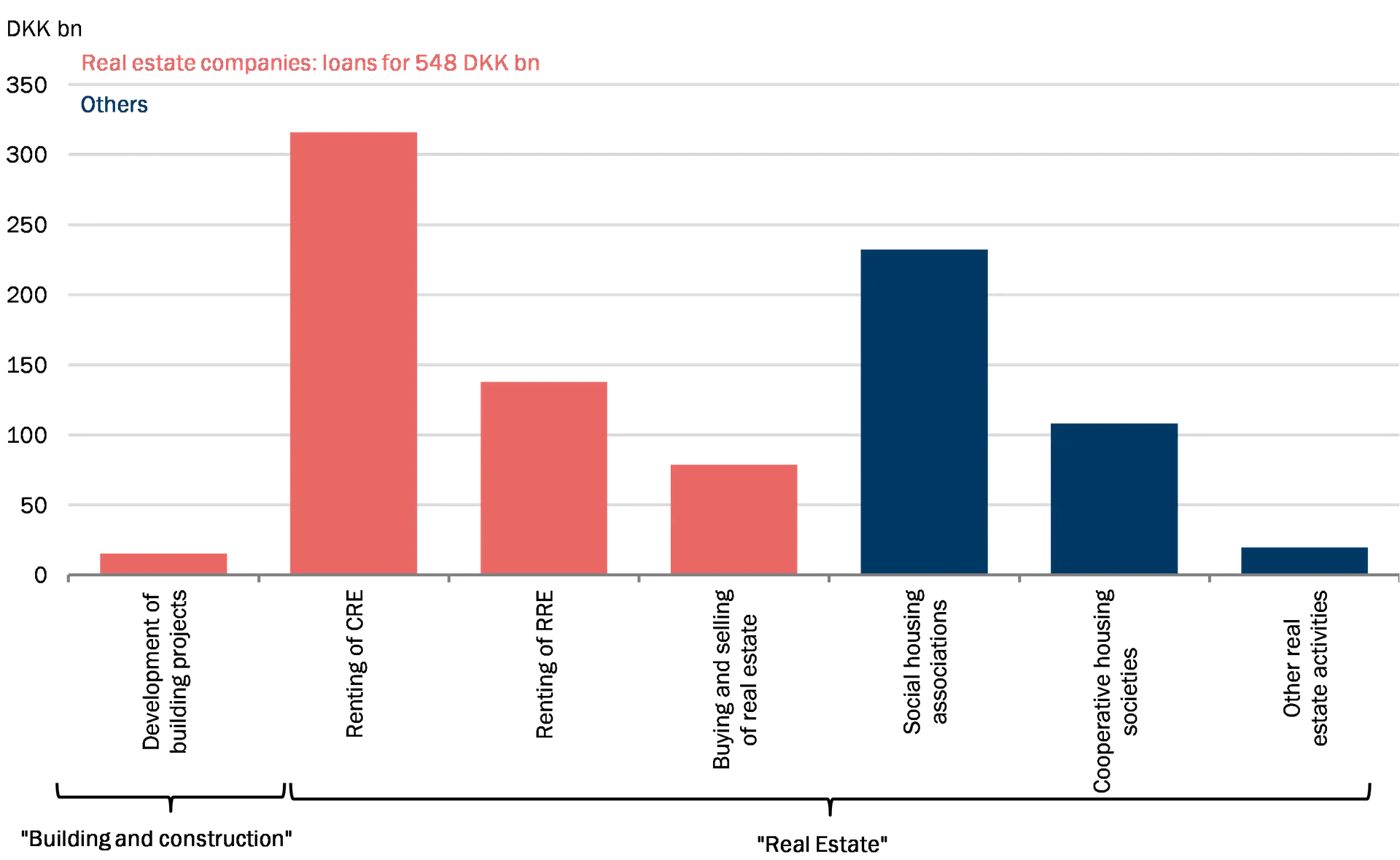

The Council recommends that the measure solely applies to exposures to real estate companies, i.e. firms engaged in activities under economic activity codes “Development of building projects” and ‘Real estate’, while exposures to ‘Social housing companies’ and ‘Cooperative housing societies" under activity code ‘Real estate’ are exempt from the measure.

A sector-specific systemic risk buffer is well-suited for addressing systemic risks related to specific loan segments

The Council recommends that the risk be addressed with a sector-specific systemic risk buffer, which aims precisely to address systemic risks related to specific segments in the credit institutions’ loan portfolio.

A sector-specific systemic risk buffer is a capital buffer requirement relative to the institutions’ risk-weighted exposures. It became possible to apply a sector-specific systemic risk buffer following the implementation of the Capital Requirements Directive (CRD V) in 2021.[2] According to CRDV, the systemic risk buffer can be used to address systemic or macroprudential risks not otherwise addressed in capital requirements.

The buffer can be used to address systemic risks in general or systemic risks related to a specific subset of exposures, i.e., as a sector-specific buffer. A number of European countries have introduced a sector-specific systemic risk buffer.[3] Unlike the other capital buffers, a sector-specific systemic risk buffer only applies to selected exposures such as loans to real estate companies. This macroprudential instrument has several advantages:

- The requirement will primarily affect institutions with exposures to real estate companies. The larger the exposure, the higher the capital requirement, in Danish kroner. A sector-specific systemic risk buffer is therefore particularly well-suited for addressing systemic risks related to specific lending portfolios. For example, for a loan of kr. 1 million with a risk weight of 20 per cent, this will entail a requirement that the institution finance a larger part of the loan, kr. 14,000, with equity rather than external financing. Currently, the institutions already have an average total capital requirement of around kr. 40,000, part of which must be met with Common Equity Tier 1 capital. The activation of a sector-specific systemic risk buffer will require the institutions to finance an additional kr. 14,000 with equity.

- The requirement is determined as a percentage of risk-weighted exposures, which means that the relative risk weighting of the underlying portfolio is maintained. Exposures with higher risk weights will therefore have a higher requirement in Danish kroner than exposures with lower risk weights.

The requirement that credit institutions must maintain a sector-specific systemic risk buffer is not a so-called hard requirement. Credit institutions that fail to comply with the requirement will therefore not lose their banking licence. Instead, these credit institutions will be required to submit a capital conservation plan to the Danish Financial Supervisory Authority, and bonus and dividend payments etc., may also be restricted if the credit institutions fail to comply with the combined capital buffer requirement.

Developments in the commercial real estate market are monitored as part of the Council’s ongoing oversight of systemic risks. Changes in the risk outlook will therefore be taken into account by the Council when determining the size of the buffer rate. A set buffer rate must be evaluated at least every two years.

Extraordinary profits enable institutions to increase their capitalisation

The institutions currently have an excess capital adequacy relative to the existing capital requirements. Furthermore, the institutions are currently generating high earnings. Therefore, the institutions will also be able to increase their capitalisation to meet a more stringent capital requirement by retaining profits. The Council consequently finds that the increased capital requirement will not affect creditworthy companies’ access to financing.

The Council’s recommendation is in compliance with current legislation.

Christian Kettel Thomsen, Chairman of the Systemic Risk Council

Statements from the representatives of the ministries on the Council

Legislation regarding the Systemic Risk Council stipulates that recommendations addressed to the government must include a statement from the representatives of the ministries on the Council. Neither the representatives of the ministries nor the Danish Financial Supervisory Authority have the right to vote on recommendations addressed to the government.

The government notes, that the Council recommends to the government to activate a sector specific systemic risk buffer of 7 per cent for exposures towards real estate companies. The government intends to follow the recommendation, as it agrees, that there are unaddressed risks related to exposures towards real estate companies.

[1] The financial crisis in Denmark – causes, consequences and lessons (Link)

[2] See also The Systemic Risk Council // The systemic risk buffer (risikoraad.dk)

[3] Read more about systemic risk buffers in other countries: Systemic risk buffer (europa.eu)